Our School District Still Owes $460,609

Of the $1.7 million fine by the Internal Revenue Service (IRS), the school district still owes $460,609.

May 20, 2022

Even after the Scarsdale Union Free School District Board of Education (BOE) announced that the school district owed $1.7 million in fines to the Internal Revenue Service (IRS) on March 30, 2022, Scarsdale residents were still kept in the dark about specific details regarding the penalty for months. However, with the frequent board meetings since then, as well as the release of the district’s payroll tax deposit records on May 10, some of the previously unclear issues have come to light.

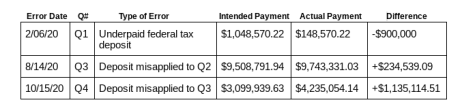

It is now known that on February 6, 2020, Scarsdale Union Free School District (SUFSD) underpaid a federal tax deposit by $900,000 ($148,570.22 instead of $1,048,570.22). The shortfall was paid a month later on March 27. On August 14, a Quarter 3 2020 federal tax deposit was misapplied to Quarter 2, resulting in an overpayment of $234,539.09. Similarly, a Quarter 4 deposit was misapplied to Quarter 3 on October 15 (a $1,135,114.51 overpayment). Rather than correcting the overpayments or refunding them, the IRS applied them to “penalties and interest that had been assessed related to the inadvertent first quarter 2020 $900,000 shortfall, therefore, causing additional shortfalls in both the third and fourth quarters 2020, respectively,” according to the affidavit of Jeffrey Martin, District Treasurer. Documents explaining the Q2 2021 error and penalty of $412,837, as well as the Q3 2021 error, have not yet been released.

The school district has repeatedly emphasized that these tax errors were accidental. “I reiterate that any and all of the errors described herein were inadvertent clerical errors and, at no point, did the Taxpayer fail in its obligation to allocate and make available the required funds for deposit…” wrote Mr. Martin in the aforementioned affidavit. However, while a single mistake is reasonable, the occurrence of five errors in just over a year seems to suggest something other than a coincidence. “There have been repeated payroll errors in 2020 and 2021, but we have not been told why these errors happened multiple times,” said Mayra Kirkendall-Rodríguez, a Scarsdale-based financial risk consultant and trainer who is very active in the school community. Mr. Martin declined to comment on the case.

So why did these errors happen multiple times? Unfortunately, despite the release of dozens of legal documents pertaining to the issue, the District and the Board of Education still refuse to answer inquiries, claiming that doing so would interfere with negotiations with the IRS. “[The lack of transparency is] what really troubles me. There is wrongdoing here, clearly,” claimed Robert Berg, a Scarsdale-based attorney who is involved in the school community and is familiar with the BOE issues. Similar sentiments seem to be quite common around this time. “It’s shocking. The district is supposed to be clear with us, but there’s zero transparency,” agreed another Scarsdale resident who requested anonymity. Indeed, twelve members of the administration and BOE declined an interview with Maroon, and ten additional members and other personnel close to the issue did not immediately respond to requests for comment.

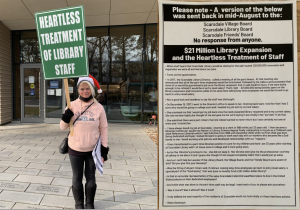

Because of the district’s absence of transparency, the tax matter has spurred a lot of community interest and attracted local media attention. In the past few months, several residents have reached out to local and/or state governments in the hopes that an agency would be able to investigate the school district’s tax issues. In early April, several news reporters made numerous requests to obtain SUFSD’s tax documents under the Freedom of Information Law (FOIL) and were eventually given access to records (which were publicly released on May 10). Maroon has filed several FOIL requests as well and is waiting to hear back from Stuart Mattey, Assistant Superintendent for Business and Facilities and District Records Access Officer.

Even though the school district is still opaque in terms of sharing information, it does seem to be trying to take the opinions of community members into consideration. During the BOE meeting on May 9, the board voted to hire a new firm with no prior connection to SUFSD to conduct a payroll audit and review of internal controls. At the end of the meeting, Mr. Mattey was authorized to issue requests for proposals (RFP) for an independent third-party auditing firm. For many Scarsdale residents, the news comes as a relief after the widespread backlash that rehiring Cullen & Danowski, LLP, the district’s current auditors, to examine the issue would have been a conflict of interest. “Thank you for voting to get an independent auditor… When significant errors or other problems happen, you need fresh eyes. Otherwise, you risk the credibility of the audit,” said Kirkendall-Rodríguez during public comments at the board meeting on May 9. Mr. Mattey also declined to comment on the matter.

In the midst of this IRS penalty matter, the school board accepted former superintendent Dr. Thomas Hagerman’s immediate resignation at a meeting on May 6. As Maroon previously reported, Dr. Hagerman already resigned in January but was going to stay and finish out the 2021-2022 school year. Then, on May 6, he resigned—effective immediately—despite there only being six weeks of school left. The resignation came just four days before the release of the district’s tax documents that suggested that Dr. Hagerman had been aware of the tax issues for over a year and chose not to disclose them to the board. “I was very supportive of [Dr. Hagerman] throughout his tenure here…I can’t feel bad for him because he created this crisis. An error was made on his watch. So what? People make mistakes. The big thing to do is not cover them up,” said Berg. If Dr. Hagerman truly had tried to cover up the IRS matter, it would mean that he breached his contract, which may have been part of why he chose to hand in his immediate resignation. During the same meeting on May 6, Dr. Drew Patrick was announced as the interim superintendent to be effective the next day. Dr. Hagerman did not immediately respond to requests for comment, and Dr. Patrick declined an interview with Maroon.

Arguably the most important question remains unanswered: the school district has paid the IRS $843,558, but where did the money come from? Scarsdale is known for its high property taxes, but will they be further increased to cover the new expense? Is the money coming from the school district’s budget? The IRS penalties and lien do “not impact the 2022-2023 budget (which is around $173,291,393),” according to Board President Karen Ceske’s remarks from a BOE meeting on April 4, but whether or not they’ll impact future budgets is still unknown. The school budget covers everything from textbooks to mental health services for Scarsdale K-12 students, so cutting over $800,000 from the fund could have severe consequences on students’ learning experiences. Paying the IRS is undoubtedly a huge burden; will the taxpayers and the students be the ones feeling its effects?

This IRS matter is long, tedious, and shocking to many, but the school board asks for the community’s patience and understanding while the tax issue is being handled. “The events of the past few weeks have been very difficult for all of us, but I want to assure the community that the Board is committed to investigating the circumstances of the IRS matter…” concluded Ceske during the April 25th board meeting.

Maroon will continue to cover the developing story.

A partial timeline of the events around the tax issue has been compiled below:

- 2/06/20: Accidental $900,000 shortfall of federal tax deposit

- 3/27/20: Aforementioned shortfall was paid off

- 8/14/20: Q3 2020 tax deposits were applied to Q2 leading to an overpayment

- 10/15/20: Q4 2020 tax deposits were applied to Q3 leading to an overpayment

- 1/11/21: Jeffrey Martin, District Treasurer, was notified by IRS of $174,798.60 penalty for the first time

- 4/26/21: Mr. Martin was notified of additional penalties for the first time

- 6/25/21: IRS sent a Final Notice/Notice of Intent to Levy and Notice of Your Rights to a Hearing

- 7/14/21: Christine Tenner, District Bookkeeper, spoke to Heidi Smith, IRS Revenue Officer, who said that the IRS wouldn’t pursue or issue a lien for the time being

- 8/9/21-9/13/21: IRS sent several notices that overpayments were applied to penalties instead of being refunded

- 9/15/21: Misters Martin & Mattey spoke to Smith and sent her an email requesting a transcript that said that the district would fully cooperate with the IRS investigation and confirmed that the IRS would not impose a lien or levy

- 10/12/21: SUFSD received a Notice of Federal Lien Filing and Your Right to a Hearing for $1,309,118.34

- 10/13/21: Federal lien filed by IRS

- 10/24/21: IRS started to talk to other people (ex. employers, employees) potentially related to the tax issue

- 11/19/21: SUFSD appointed Jessica M. Blanchette & Frank C. Mayer as its tax attorneys

- 1/10/22: SUFSD received a notice for a Q2 2021 tax error

- 2/18/22: Debra A. Daugherty, IRS Appeals Officer, received SUFSD’s Request for a Collection Due Process or Equivalent Hearing (request for lien withdrawal)

- 3/25/22: School District told BOE about tax issues

- 3/30/22: BOE revealed tax issues to the general public

- 4/04/22: SUFSD received a notice for a Q3 2021 tax error

- 4/06/22: SUFSD paid the IRS $843,558

- 4/20/22: BOE hired Anthony Brock to investigate the tax issue

- 4/25/22: Brock started his investigation

- 5/06/22: Dr. Thomas Hagerman tendered his immediate resignation

- 5/09/22: BOE voted to hire an independent third-party firm to provide the district’s audit

- 5/10/22: FOIL documents pertaining to the tax issue were released to the public

Mayra Kirkendall-Rodriguez • May 22, 2022 at 9:27 am

Dear Ms. Chu,

Good job. Thank you for covering this important issue. It is unfortunate that while the Scarsdale curriculum encourages curiosity, posing questions, being analytical, and good writing, neither the District nor the Board of Education are answering any of your questions or that of taxpayers. Do not give up. You are providing a great service to all Scarsdale residents.

Here are a few more questions you might want to ponder:

1) When did Mr. Martin notify Mr. Mattey about the payroll errors?

2) Did Mr. Mattey ever notify any member of the Board of Education during 2020-March 24, 2022? Mr. Mattey is the Assistant Superintendent for Business. As per the District’s website this is what the Business Office does: “The Business Office is responsible for all financial management, maintenance of liability insurance, compliance with State reporting requirements, payroll, accounting tasks (including preparation for the annual independent audit), and purchasing. Additionally, the Department prepares the annual budget for review by the Board of Education, and presents monthly financial reports at the Board’s public meetings.” Wouldn’t letters from the IRS about penalties and a lien be considered financial information that should have been reported to the Board immediately?

3) How is it that Messrs. Martin and Mattey and some of their staff members were writing and talking to the IRS during 2021 and not one single Board member was made aware of this or knew that this was happening?

4) Why is Mr. Mattey also responsible for determining what Freedom of Information Law (FOIL) requests are honored and how? Isn’t it a conflict of interest that any FOIL request about the IRS matter is being determined by him, the head of the Business Office, where the payroll errors occurred?

5) The last contract for the District’s counsel shows that the firm was hired for labor matters. Did the District need the Board of Ed’s permission to use the firm for the IRS matter? Did that law firm notify the BOE about the IRS matter? How can the law firm act behind the BOE’s back?

6) How did the BOE choose Brock to be the independent investigator? Did the BOE interview anyone else? What assurances can the BOE give, that neither the District nor members of the BOE are interfering in any way with Brock’s investigation?

7) Is the Business Office creating a Request for Proposal and leading the search for a new internal auditor that will come and audit it? What exactly are Messrs. Martin’s and Mattey’s role in this upcoming payroll audit? What safe guards will the BOE recommend to guarantee the independence and credibility of this audit?

8) How much will all these new auditors, investigators and additional hours for counsel cost Scarsdale taxpayers?

9) Has the District contacted the Office of the Comptroller or the New York State Education Department about this matter? Have those offices contacted the District? Will the District have to submit any restated financials to those offices?

Best regards,

Mayra Kirkendall-Rodriguez